Enventure Way

Elevating the current VC/PE model

Enventure is a VC/PE team with backgrounds from IBM, Deloitte, NASA, UMC, Goldman Sachs, and the Columbia Endowment Fund, etc. The combined experiences include 70 years in healthcare, 30 years in space tech, 25 years in green tech, and 25 years in semiconductor R&D, backed by knowledge across government affairs, investment banking, M&A, finance, and legal industry. Our founder, Ankit, has managed P&L > $1B/year with partners for 10+ years, the core team has collectively worked with 90+ startups. Combining AI/data and human intelligence drives our work.

- Our unfair advantage: our cross-border presence in the US, India, Taiwan, and Latam enables us to access top innovations, help scale businesses across borders, and tap market white spaces or key capabilities internationally.

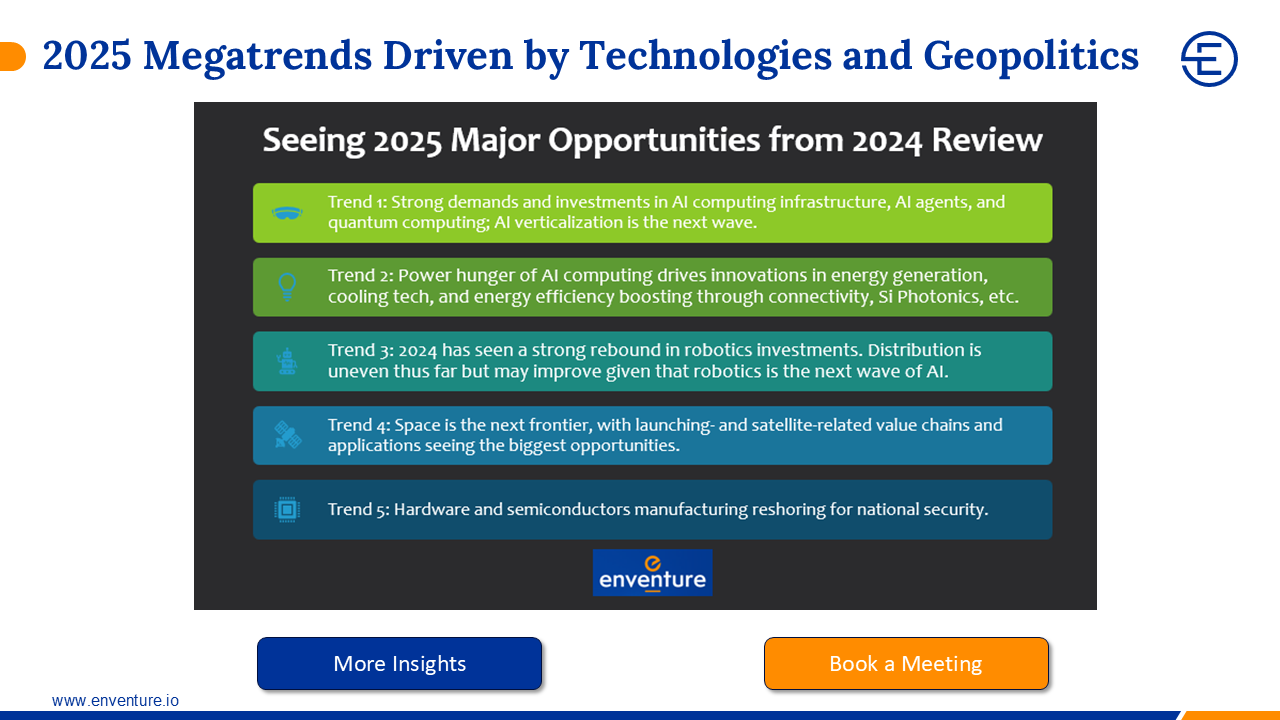

- Selective investments: we invest in early-stage startups backed by top investors with track records in our focused sectors—intersections of megatrends in the US and India with CAGR > 20%.

- Exit-driven: We begin with the end (exit) in mind. See the exit strategy in our deck.

We're raising a $100M PE and $50M VC fund, with $10M already committed. We're inviting strategic LPs for a quite favorable term now with co-investing and GP staking; and we invite strategic LPs to get involved in our decision-making process, to our advisory board, or advise startups if interested.